TravelTalkOnline

Another ATM skimming incident

Posted By: Carol_Hill

Another ATM skimming incident - 08/05/2023 12:49 PM

LinkIf you use an ATM in SXM (and here in the US for that matter!!), please educate yourself as far as what to look for on the machine. This is two skimming incidents within a space of a month, that have been discovered on SXM. This could be really bad, if you are on island, and someone empties your bank account.

Posted By: CanuckTravlr

Re: Another ATM skimming incident - 08/05/2023 02:05 PM

Wow, Carol. I deal with RBC here at home in Canada, so I have used the ATM at that RBC branch in Philipsburg, as recently as last February. For a major bank, a skimming incident is a bit unusual, but certainly not unheard of. Glad to hear that RBC has returned any funds and replaced the debit cards.

Your advice is excellent. Even when on island i automatically check my accounts daily, just as I do at home. I do know what to look for in detecting a fraudulent skimmer, but they are getting more sophisticated all the time. It is a little scary in any case, so thanks for that warning.

Posted By: WWII

Re: Another ATM skimming incident - 08/05/2023 02:14 PM

That's why I never use a debit card.

Posted By: CanuckTravlr

Re: Another ATM skimming incident - 08/05/2023 02:29 PM

Certainly that's your choice, but I've been travelling internationally for over half a century with a debit card without any issues. Credit cards can also be hacked and cash can be stolen or taken by armed robbery, but both those likelihoods are just as rare as debit card skimming. Different strokes for different folks.

Posted By: SXMScubaman

Re: Another ATM skimming incident - 08/05/2023 02:59 PM

Only cash or Credit Cards for me.

Posted By: jollymonsrv

Re: Another ATM skimming incident - 08/05/2023 03:07 PM

Bingo. Scammed once. Never again

Posted By: WWII

Re: Another ATM skimming incident - 08/05/2023 03:21 PM

Credit cards don't provide direct access to your bank account.

Posted By: CanuckTravlr

Re: Another ATM skimming incident - 08/05/2023 03:27 PM

So, a question for those voting for cash and CC. How do you get more cash out, if you need to when on the island? If you use your CC, it is treated like a cash advance and interest is charged. Your credit card is also then exposed to skimmers. So i really don't undrstand how it is safer.

There is one other factor at play here, which does not apply to any of you. I'm Canadian. I don't operate in USD on a normal basis. So I don't want to have an excess amount of US cash with me. If I need more I go to the ATM. I have a US dollar bank account and US VIsa card (in addition to my Canadian ones) with RBC's US affiliate. I use those when travelleing to places like the USA and St. Martin, where things are denominated in USD. I keep a limited amount of cash in the account, since I can easily transfer more from my Canadian accounts online with the push of a button. So my exposure to theft is limited, and RBC will indemnify me if it happens.

I don't use my debit card for making foreign purchases, only for accessing cash. Purchases are only CC or cash. So i don't understand the aversion to debit cards. Maybe it's a US banking thing for some reason? I'm also staying on the island for 3 to 5 weeks at a time, so maybe that makes a difference?

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/05/2023 03:29 PM

CanuckTravlr--We don't even own a debit card, as here in the US anyway, banks often do not replace funds taken via a debit card, versus a fraudulent charge on your credit card. Often, those are "inside situations". Now, if there is a skimming incident, I would assume, without knowing, that they would replace the funds.

This is just one more example of how, just because you're on vacation, doesn't mean that you shouldn't take precautions.

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/05/2023 03:33 PM

CanukTravlr--we NEVER get extra cash on island. We monitor our cash to make sure we have enough and charge most things. We always come home with cash.

Posted By: CanuckTravlr

Re: Another ATM skimming incident - 08/05/2023 03:38 PM

Ok, that helps explain it Carol. I am a retired financial professional and do have some experience in dealing with US banks at a non-personal level, as well as personal. I do know that the US banking industry is very fractured, since it is state regulated, unlike Canada and most European countries where is is regulated at the national level.

In my experience the US tends to be behind the curve, compared to its European and Canadian counterparts. We have required PINs for years, so that adds an additonal level of security that has only recently become more common in the US. Here in Canada, and in Europe as well, except at small merchants or for very small transactions, cash is rare, almost everything is either debit or CC. And yes, our regulations do provide more indemnification, so that obviously helps. Both CCs and debit cards are virtually the same in terms of protections.

Thanks for alerting me to some of the differences. It now makes more sense. And I only go to an ATM if I need MORE US cash. I never want to go home with US dollars any more than necessary, since I can't use them at home. It makes no sense to have them sitting there doing nothing until my next trip, IMO.

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/05/2023 03:41 PM

Yes, for sure, many things are different here than our neighbors to the north!!

edit--CanuckTravlr --since you are an RBC customer, could you go into the bank there and cash a check?? Just curious.

Posted By: SXMScubaman

Re: Another ATM skimming incident - 08/05/2023 03:53 PM

We just take more cash in diffeeent denominations than we'll really need and put most on CC to get the miles. Just because you don't use all the cash you take doesn't mean it's gone. Just bring it back with you.

Posted By: CanuckTravlr

Re: Another ATM skimming incident - 08/05/2023 03:54 PM

Probably, but I have no actual experience with that. In fact, I can't remember the last time I actually wrote a physical cheque. Most payments like that here in Canada are done by either CC or online by electronic transfer (e-transfer). I don't know if the latter even exists in the US. On a side note, I did once years ago negotiate a cheque in pounds sterling from a relative in the UK, drawn on a UK bank, at the then RBC branch in Paris, while I was travelling. They did put me through a couple of additional hoops to verify my bona fides, but I did get the cash successfully.

Posted By: CanuckTravlr

Re: Another ATM skimming incident - 08/05/2023 04:01 PM

@Scubaman, Yes I know it's not gone if I keep it for the next time, but it costs me a foreign exchange fee to buy the US dollars in the first place. So if I leave with cash from home for use on the island, I have to buy it. I can't pull it out in cash from my US bank account, unless I am outside the country. So, I try to estimate how much cash I will need, but sometimes it isn't enough and I have no choice but to use an ATM.

But it's also not gone, and is useable here at home, if I don't transfer it to USD in the first place. Just sayin'

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/05/2023 04:35 PM

Canuck--I write checks to the gal who cuts my hair and the gal that grooms my dogs!

Sometimes I write checks to my vet too. I'm old!

Posted By: kim

Re: Another ATM skimming incident - 08/05/2023 05:32 PM

I have an account with RBC on SXM. They no longer offer checks!!! Not sure if you can go in and cash one but we received notice that they no longer accept checks!!!! I write maybe 3 a year in the states and do most banking electronically or with credit card.

Posted By: SXMScubaman

Re: Another ATM skimming incident - 08/05/2023 05:48 PM

I must be old too as we write and deposit checks all the time both personally and for my side business.

Posted By: CanuckTravlr

Re: Another ATM skimming incident - 08/05/2023 07:58 PM

I'm not young, either, almost to the 3/4 century mark, but in Canada at least, cheques are now pretty rare. The banking systems, while similar, are quite different to the US, IME, and our online and clearing processes are also much faster and more integrated, even between different banks. I am surprised that RBC in Sint Maarten is no longer accepting cheques, certainly RBC in Canada still does! Anyway, this has gone a bit off topic, so I will let it rest there.

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/05/2023 08:00 PM

Scuba--my clientele are mostly over 65, as my practice now is mostly an estate planning practice, but I would say at least half of my clients pay with checks.

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/05/2023 08:01 PM

Canuck--I don't agree that this has gone off track, talking about getting money on SXM...

Posted By: CanuckTravlr

Re: Another ATM skimming incident - 08/05/2023 08:06 PM

OK, thanks Carol. Because it had switched to a discussion to a great degree about the differences in US/Canadian banking, and not so specifically about processes in Sint Maarten, I was concerned about potentially hijacking the thread. But I guess you're right, it's still useful information for North American visitors.

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/05/2023 08:15 PM

The thread just being here is good information and a warning to those who use ATMs in SXM.

Posted By: islandgem

Re: Another ATM skimming incident - 08/06/2023 01:03 AM

The RBC banks on the island are not affiliated with the Royal Bank of Canada . RBC there stands for Royal Bank of Caribbean and are very different banks. I am a Royal Bank customer in Canada too and I was informed of this from my bank.

Posted By: bdeeley

Re: Another ATM skimming incident - 08/06/2023 02:00 AM

RBC in SXM is the Royal Bank of Canada and became so in June 2008 when RBC acquired RBTT Financial. The new organization became RBC Financial Caribbean, wholly owned by RBC.

Posted By: CanuckTravlr

Re: Another ATM skimming incident - 08/06/2023 04:09 AM

@bdeeley is correct. And IME most RBC employees are unfamiliar and poorly informed concerning the foreign operations of the parent bank. They just can't see them on their branch network, so assume they are not the same. RBC US and RBC Financial Caribbean are separate incorporated banks, different from the domestic operatoins in Canada, for legal and regulatory reasons. They do not share branch operations, so yes, they are not the "same" bank, but they do work with clients of other RBC banks on a preferred basis.

When I pull money out of an RBC ATM in Sint Maarten, I am charged a witthdrawal fee, unlike here at home. But ulitmately, as @bdeeley says, they are all subsidiares of the parent bank. I was able to park in the parking lot at the branch in Philipsburg, reserved for RBC customers, by simply showing them my domestic RBC Client Card, so there is some recognition.

Posted By: timnboston

Re: Another ATM skimming incident - 08/06/2023 10:40 AM

For what it's worth - I bring plenty of cash (I find that it's generally widely accepted - lol) but leave it in my unit's safe. I only take out whatever I've budgeted for that day, so I never risk a major loss. It also keeps me on "on budget". On those rare occasions when I've needed more cash, I go into the bank with my ATM card and plead elderly stupid tourist (not always an act) - a bank employee is always willing to be most helpful.

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/06/2023 12:25 PM

tim--we also leave all of our cash in the safe in the room, except for what we need for that day. But not to ask a stupid question, but do banks in SXM have an ATM inside the bank? If not, how does a bank employee get you money?

Posted By: BillandElaine

Re: Another ATM skimming incident - 08/06/2023 12:44 PM

No banks here (Dutch side) will accept checks anymore. Probably been a year. They want everyone to go digital, jerks.

Posted By: timnboston

Re: Another ATM skimming incident - 08/06/2023 12:58 PM

They will come outside with me to help - it is the friendly island!

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/06/2023 01:04 PM

tim--OK, but if there is a skimmer on the ATM, then it doesn't matter if you work the ATM or they do?

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/06/2023 01:05 PM

Elaine--OK, guess that wouldn't work then.

Posted By: boucharda

Re: Another ATM skimming incident - 08/06/2023 01:49 PM

Maybe I'm in the minority but I never carry a lot of cash with me....anywhere. I bring maybe $300 with me and the rest is on a CC. If I do need cash for a non-CC accepting place I use my no fee Schwab Debit card in a place with a decent amout of people around the ATM...like inside a Carrefour or similar. My card maxes out at $500/day withdrawals...no clue how someone got $4000 from one account in one day

There are a lot of free standing ATM's in the world in some not too secure places. I find it interesting that the article does not mention where the machine (s) are located

I have used ATM's in MANY countries and am always choose the location carefully but it all comes down to doing what you feel most comfortable with, Hotel/resort sales are pretty secure but not 100%

Hotel safe link

Posted By: Southshore

Re: Another ATM skimming incident - 08/06/2023 02:50 PM

Regarding the question of how someone could get $4000.00 in one day.... It depends in what the daily withdrawal limit is on the card. You can have a limit in the thousand's per day, at least here in Canada you can. Also, the limit resets at midnight. So you can withdraw the limit at 11:55 p.m., wait a few minutes until the calendar ticks over and pull out the limit again.

Curious about Canuck Travlrs comment about paying foreign exchange fees for purchasing US dollars. Are you referring to the exchange rate or are you paying an an additional fee on top of that for the purchase? I am a retiree from one of the Big Five Canadian banks and do not pay any additional fees for the purchase of US cash, just the exchange rate, which, for staff and retirees, is lower than the rate to the public. I have never paid any bank fees, ever, either as a working staff member or as a retiree.

Also, I think I have mentioned this before re getting US cash in Canada - the exchange rate is usually lower if you withdraw US cash at an ATM that provides that service. The rate is reduced due to the fact that counter staff don't have to handle the transaction.

Posted By: GaKaye

Re: Another ATM skimming incident - 08/06/2023 03:19 PM

I haven't read every post here, so please forgive me if I repeat something that's already been said. I'm a retired banker, with over 30 years of experience in regulatory compliance. There's a big difference between what the bank is required to do with suspected debit card fraud and credit card fraud. Also, even though you might use the same card to withdraw money from an ATM as you do to debit your account to purchase something at a store, the regulations are different. Yes, skimming is always a risk, but the bank is required by regulation to provisionally restore any funds that you claim have been withdrawn from an ATM without your authorization. Not so if you use your card as a debit card to purchase something. Also, please know that I'm speaking of REQUIREMENTS, and those for US banks. Some banks may do more than is required. The law REQUIRES credit card companies provisionally set aside any charge that's disputed as fraudulent, unless or until it's proven otherwise.

I've NEVER used a debit card, and only use an ATM card in a true emergency. I've seen too many instances of people having all of their money taken, and it taking months to prove the fraud and have the funds restored. We take much more cash than we need on trips, and keep it in the safe. We take with us what we think we'll need for the day, and use credit cards for every transaction where that's allowed.

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/06/2023 03:49 PM

Georgia--thanks for the bankers point of view.

Posted By: SXMScubaman

Re: Another ATM skimming incident - 08/06/2023 03:50 PM

"We take much more cash than we need on trips, and keep it in the safe. We take with us what we think we'll need for the day, and use credit cards for every transaction where that's allowed."

Same here.

Posted By: boucharda

Re: Another ATM skimming incident - 08/06/2023 03:58 PM

Not to prolong the great points made here but when I mentioned using my Schwab debit card I meant my ATM card and only for getting cash. CC or cash for everything else....I never use a debit card for purchases (no points )

Posted By: ruralcarrier

Re: Another ATM skimming incident - 08/06/2023 04:15 PM

Georgia, Thanks for the input. I am with you on the Debit Card viewpoint. I don't have one, don't want one and would not use one.

I have only used an ATM a very few times here at home, not a fan of them at all.

Same with the cash situation. Take plenty, leave what you don't need that day or night in the safe. I somewhat learned the hard way. I either lost or had my wallet stolen at a restaurant several years ago (on the island) so I was out credit cards, license, etc. but did not have all my cash in it, but I had more than I would carry now.

When we dine out, often one person will charge for the group and then the others pay them back later in cash.

Posted By: SXMScubaman

Re: Another ATM skimming incident - 08/06/2023 06:16 PM

I'm more than happy to pay for the group with my CC as i get the miles.

Posted By: CanuckTravlr

Re: Another ATM skimming incident - 08/06/2023 06:33 PM

@boucharda The article clearly says that the ATM was at the RBC in Philipsburg. If you look at the picture at the top of the article, you can actually see the two ATM machines, inside separate areas, on either side of the main doors. In February, I used the one on the left!

I agree with you about not using isolated ATMs, or at night, especially in a strange area. I used that particular ATM at mid-day, with lots of people around. Another rule for me when travelling is to only use an ATM at a major bank, not a freestanding, third-party ATM. And I too, have a daily cash withdrawal limit of well under $1,000 per day, so that also limits any potential damage. So far, so good, and I have used my debit card throughout Canada, the USA, Europe, and the Caribbean for decades. But everyone has to do what makes them the most comfortable.

@Southshore Yes, I was referring to the foreign exchange rate only. I have no fees with my bank. The only real fee I was referring to was the $6 USD withdrawal fee by RBC in Philipsburg, since I'm not technically a client there. And yes, I usually use one of the ATMs that will dispense USD here at home. The rate is good and its more convenient than ordering foreign cash, or standing in line to see a teller. And I am also a senior, plus my banking package also entitles me to a "preferred" exchange rate when accessing foreign cash, whether, USD or Euros, etc. So I agree with all your comments.

Posted By: bobbarb

Re: Another ATM skimming incident - 08/07/2023 01:46 AM

While I am not a banker but a retired CPA and never had or will ever get a debit card even though Wells Fargo keeps offering. I have a number of credit cards 8 or 9 and use the ones that give the best rewards. I only pay for my United card as it gives free luggage and lounge pass and collision insurance which more than covers the cost of the card. I have 4 cards that had to be cancelled because of fraudulent activity and never had any cost or problems. I am sure I would not have been as fortunate with a debit card. Also even at home I always use a credit card whenever possible even for small purchases which my wife thinks is crazy.

Posted By: SXMScubaman

Re: Another ATM skimming incident - 08/07/2023 02:23 AM

"Also even at home I always use a credit card whenever possible even for small purchases which my wife thinks is crazy."

Those rewards and miles add up.👍

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/07/2023 01:13 PM

As a merchant, I find it annoying when someone tries to use a credit card for something like $5, as it does cost US when you use a credit card, versus paying cash.

Posted By: Jim_Laraine

Re: Another ATM skimming incident - 08/07/2023 01:41 PM

Hope this is not too far off topic but, has anyone noticed SXM businesses adding a surcharge on credit card sales? In NY and the midatlantic we've found that many merchants are adding on about 3% for the use of credit cards to cover their processing costs. I understand why merchants do that, but it pretty well wipes out the benfit of using the card. Also, in almost all cases, the server or cashier did not alert us to the charge.

On a related topic, for SXM travel, we will be using the United Explorer Visa card which does not charge a foreign exchange fee.

Posted By: bizzottom

Re: Another ATM skimming incident - 08/07/2023 01:45 PM

ditto SXM, use CC for every possibility, it all adds up in the end

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/07/2023 01:51 PM

I have not personally seen any merchants in SXM adding a fee for credit card processing. Florida law prevents merchants from charging a credit card fee. Possibly SXM laws do also.

Posted By: Jerry_R

Re: Another ATM skimming incident - 08/07/2023 02:07 PM

I thought so too. Please view this. I am not happy with what I just found out. This is from the Office of the Florida Atty. General, Ashley Moody.

I just had a rather expensive car repair & the shop (in Punta Gorda, FL) wanted a 4% fee to use my card. I paid with a check. No fee.

https://www.myfloridalegal.com/cons...charges#are-credit-card-surcharges-legal

Posted By: ruralcarrier

Re: Another ATM skimming incident - 08/07/2023 02:07 PM

I don't recall seeing it on SXM but unless there is a law against it, I would expect to see it happening.

Both where we live (OH) and in US travels, I have seen a 2% to 4% fee added when using a CC. I believe it is usually noted on the menu or at the register. Some restaurants will show the total WITH the fee and then offer something like a 3% discount if paying in cash.

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/07/2023 02:24 PM

Jerry--OK, I didn't remember that.

Posted By: SXMScubaman

Re: Another ATM skimming incident - 08/07/2023 02:56 PM

Yes. Aqua Mania adds a credit card fee to a CC charge for their excursions. I have also encountered an added CC fee at other places in SXM but can't remember where. I do recall that when we paid for our Eagle excursion there was an extra fee for a CC so we paid cash.

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/07/2023 03:53 PM

Huh. Well, I guess I will have to look at charge slips on SXM more closely from now on.

Posted By: Zanshin

Re: Another ATM skimming incident - 08/07/2023 04:31 PM

The credit card surcharge (or a cash discount) is not allowed in the EU or on the French side.

Posted By: kim

Re: Another ATM skimming incident - 08/07/2023 04:41 PM

Carol - in Florida can you offer a fee, and then a 3% discount if paying cash or check? That’s how we get around it in CT. Customers can mail me a check, pay online via ACH and get a discount or with CC for the full charge.

Posted By: Jerry_R

Re: Another ATM skimming incident - 08/07/2023 04:42 PM

I used to charge bigger things like this regularly. Never a card fee. This one was about $1400. New front struts on my minivan. I knew that there was legislation that prevented a CC usage charge. Fortunately they told me up front so I brought my checkbook. Funny we didn't hear about this on the news here in FL.

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/07/2023 05:01 PM

kim--It could be. I just eat the charge, even though it is annoying.

Posted By: islandgem

Re: Another ATM skimming incident - 08/07/2023 05:07 PM

As of April 2021 the Royal Bank of Canada sold their Caribbean RBC banks to the National Bank so things are different now.

Posted By: jazzgal

Re: Another ATM skimming incident - 08/07/2023 05:18 PM

Horny Toad charges extra for using a credit card. I have taken to paying them via Venmo to avoid the surcharge.

Posted By: ruralcarrier

Re: Another ATM skimming incident - 08/07/2023 06:58 PM

Correct. When we used to book Regatta excursions, there was always a small fee for using a credit card. At least on the last few we booked there was a fee.

Posted By: bdeeley

Re: Another ATM skimming incident - 08/07/2023 07:14 PM

No they did not, they sold what they called their Eastern Caribbean banks and kept others.

They sold; 11 branches in Antigua and Barbuda, Dominica, Grenada, Montserrat, St. Kitts and Nevis, St. Lucia, and St. Vincent and the Grenadines.

The following is what remained after the sale above. RBC’s Caribbean presence comprises 3,000 employees and 41 branches and offices. Locations include Aruba, The Bahamas, Barbados, Bonaire, Cayman Islands, Curaçao, Saba, Sint Maarten, Trinidad and Tobago, Turks and Caicos Islands.

Posted By: kim

Re: Another ATM skimming incident - 08/07/2023 07:26 PM

As of April 2021 the Royal Bank of Canada sold their Caribbean RBC banks to the National Bank so things are different now.

I’m confused. If you read this press release, it sounds like RBC still owns some banks - including Sint Maarten.

https://www.investmentexecutive.com...es-sale-of-eastern-caribbean-operations/

Posted By: bdeeley

Re: Another ATM skimming incident - 08/07/2023 09:10 PM

They do. See my prior post.

Posted By: kim

Re: Another ATM skimming incident - 08/07/2023 10:43 PM

I thought so - I have a checking account, mortgage and CD with them since 6/2017 (my timing could have been better!!) and knew they were still affiliated. But there is no connection when it comes to banking with them in the US or Canada. They can’t see the accounts. Only in Sxm. Just wish they didn’t close the Simpson Bay branch!!!

Posted By: CanuckTravlr

Re: Another ATM skimming incident - 08/08/2023 04:52 PM

I agree with you, KIm. I was very disappointed when they closed the Simpson Bay branch, since I usually stay on Simpson Bay Beach, so it was easy to get there. Initially, they kept the ATMs operating at the Simpson Bay Branch location and the Cole Bay Carrefour, but even those now are closed. I don't have any accounts on SXM itself, since I'm normally only down once a year.

Posted By: bdeeley

Re: Another ATM skimming incident - 08/14/2023 03:03 PM

This post is meant to correct a lot of incorrect and misinformation shared in prior posts.

Certainly that's your choice, but I've been travelling internationally for over half a century with a debit card without any issues. Credit cards can also be hacked and cash can be stolen or taken by armed robbery, but both those likelihoods are just as rare as debit card skimming. Different strokes for different folks.

ATM/ABM cards did not get introduced in Canada until 1969 and it wasn’t until the late 70’s that many Canadian banks were using them for cash withdrawals. Debit Cards did not come into use in Canada until 1988, just a short 35 years ago and far less than the over half a century mentioned.

Ok, that helps explain it Carol. I am a retired financial professional and do have some experience in dealing with US banks at a non-personal level, as well as personal. I do know that the US banking industry is very fractured, since it is state regulated, unlike Canada and most European countries where is is regulated at the national level.

America enjoys a robust banking system where banks are either Federally Chartered or State Chartered. Over 20% of banks operating in the US are Federally Chartered. Over 94% of all banks operating in the USA are regulated, in some way, by the Federal Government. This regulation takes place by the OCC (Office of the Comptroller of the Currency), the Federal Reserve or by the FDIC. Many banks are regulated by multiple federal organizations. Many State Chartered banks are members of the Federal Reserve.

In my experience the US tends to be behind the curve, compared to its European and Canadian counterparts. We have required PINs for years, so that adds an additonal level of security that has only recently become more common in the US. Here in Canada, and in Europe as well, except at small merchants or for very small transactions, cash is rare, almost everything is either debit or CC. And yes, our regulations do provide more indemnification, so that obviously helps. Both CCs and debit cards are virtually the same in terms of protections.

The US has required PINs for years, first with the use of ATM cards and then with the advent of the DEBIT cards, when used in “debit mode”. The US adoption of the PIN with these cards predates the use by Canadians for many years.

And, no, your regulations do not provide more indemnification. For instance, both the US and Canada indemnify credit card users for all fraudulent amounts in excess of $50. Exactly the same, except the US protection was enacted in 1974 with the FCBA (Fair Credit Billing Act (Federal protection)) and in Canada that protection was not written into Canadian law until 1991 with the Canadian Bank Act (PART XII.2), 17 years later than the US.

On the Debit side the US laws are just as protective for the citizens, and again, predate Canadian protections for their citizens. Americans have enjoyed protections for Debit Card use since 1978, when the US Government enacted the EFTA (Electronic Funds Transfer Act). If you want to talk about Chip and Pin than yes, Europe and Canada enacted those measure earlier then the US, but for purchasing in the US, we mostly use Chip and Signature with our Debit Cards and Chip and Pin for ATM. Most US and Canadian credit and debit card transactions are now protected by the Zero Liability Policy provided by the Card Issuers, and the coverage is the same. Obviously, your knowledge of American Banking, Credit and Monetary policy is quite mis-informed.

And for all the emphasis you want to put on adoption of Chip and Pin, it provides no protection for CNP(Card Not Present) transactions. CNP transactions account for more than 1/3 of all debit card transactions and account for 80% of all debit card fraud.

Probably, but I have no actual experience with that. In fact, I can't remember the last time I actually wrote a physical cheque. Most payments like that here in Canada are done by either CC or online by electronic transfer (e-transfer). I don't know if the latter even exists in the US.

.

“e-transfer” is a branded product of the Canadian “Interac” system. Interac was created in 1994.

**Interac e-Transfers are only available in Canada for individuals who have Interac-partnered bank accounts (most of them). So, no you cannot use Interac e-Transfer in the U.S. That being said, Interac does have a collaboration with Mastercard and Western Union to allow Canadians to send International Transfers. (Forbes Magazine, 04/2023).

Electronic Funds Transfer, was created in the US in 1871. It was first handled by Western Union. EFT has a long history in the US, dating back more than 150 years. I think we have made additional enhancements in the ensuing years.

I'm not young, either, almost to the 3/4 century mark, but in Canada at least, cheques are now pretty rare. The banking systems, while similar, are quite different to the US, IME, and our online and clearing processes are also much faster and more integrated, even between different banks. I am surprised that RBC in Sint Maarten is no longer accepting cheques, certainly RBC in Canada still does! Anyway, this has gone a bit off topic, so I will let it rest there.

Again, you have limited to no knowledge of US Banking and consumer credit policy. Usually, it takes about two business days for a check to clear in the US. That can vary from check to check, though. There are a few factors that might cause a check to clear faster than two days. Banks are generally required by law to make the first $225 of a check deposit available by the next business day. For example, if the check is deposited on a weekend, it’s considered to be deposited on Monday, so the first $225 of the check will be available on Tuesday. Canada has the same average clearance time but only quarantees the depositor the first $100 being available the next business day. Again, Americans enjoy these protections by Federal Law; The Expedited Funds Availability Act, Check Clearing for the 21st Century Act, and many more.

The RBC banks on the island are not affiliated with the Royal Bank of Canada . RBC there stands for Royal Bank of Caribbean and are very different banks. I am a Royal Bank customer in Canada too and I was informed of this from my bank.

This was addressed earlier and is totally incorrect.

@bdeeley is correct. And IME most RBC employees are unfamiliar and poorly informed concerning the foreign operations of the parent bank. They just can't see them on their branch network, so assume they are not the same. RBC US and RBC Financial Caribbean are separate incorporated banks, different from the domestic operatoins in Canada, for legal and regulatory reasons. They do not share branch operations, so yes, they are not the "same" bank, but they do work with clients of other RBC banks on a preferred basis.

When I pull money out of an RBC ATM in Sint Maarten, I am charged a witthdrawal fee, unlike here at home. But ulitmately, as @bdeeley says, they are all subsidiares of the parent bank. I was able to park in the parking lot at the branch in Philipsburg, reserved for RBC customers, by simply showing them my domestic RBC Client Card, so there is some recognition.

RBC Bank in the Caribbean is wholly owned and operated by RBC Royal Bank. Yes, they have to be organized and operated by the laws governing their location, but they are 100% owned and controlled by RBC Royal Bank of Canada. There are links to the Caribbean banks right on RBC’s website and you can login and manage your accounts right from the RBC website. Lack of knowledge on someone’s part doesn’t make it true or accurate. Corporate Leadership still resides with the Parent Bank in Canada.

@boucharda The article clearly says that the ATM was at the RBC in Philipsburg. If you look at the picture at the top of the article, you can actually see the two ATM machines, inside separate areas, on either side of the main doors. In February, I used the one on the left!

NO, the article does not say, in any way, that the ATM was at the RBC branch location in Philipsburg. The article states that the skimming happened at an ATM machine but did not give its location. RBC has branded ATMs at other locations on the island or it could have been an independent ATM. All the article makes clear is that RBC clients were affected.

The Daily Herald often uses that picture of RBC as a stock photo for any articles about RBC. If you infer that it was at the RBC branch because of the word PHILIPSBURG at the top of the article than again you would be wrong. That would be the “Dateline” of the article and it is usually at the beginning of the article and tells you where the article was written or filed. Usually the date is omitted and the location is in all capitals.

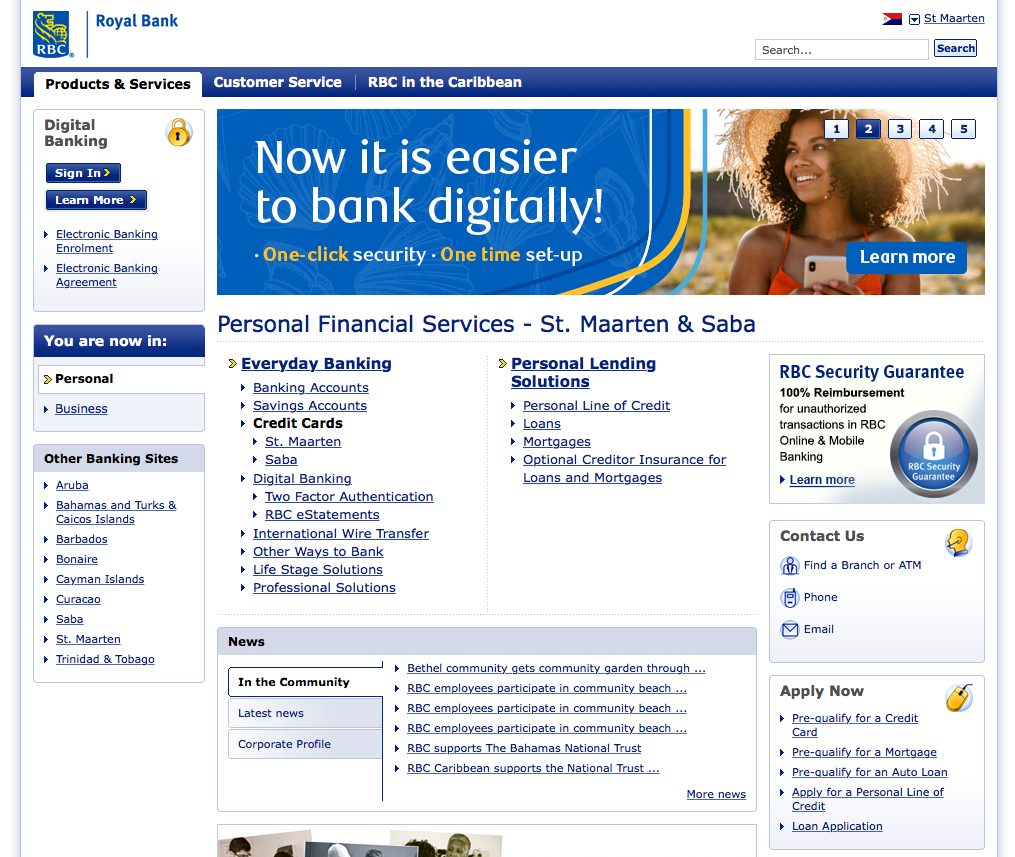

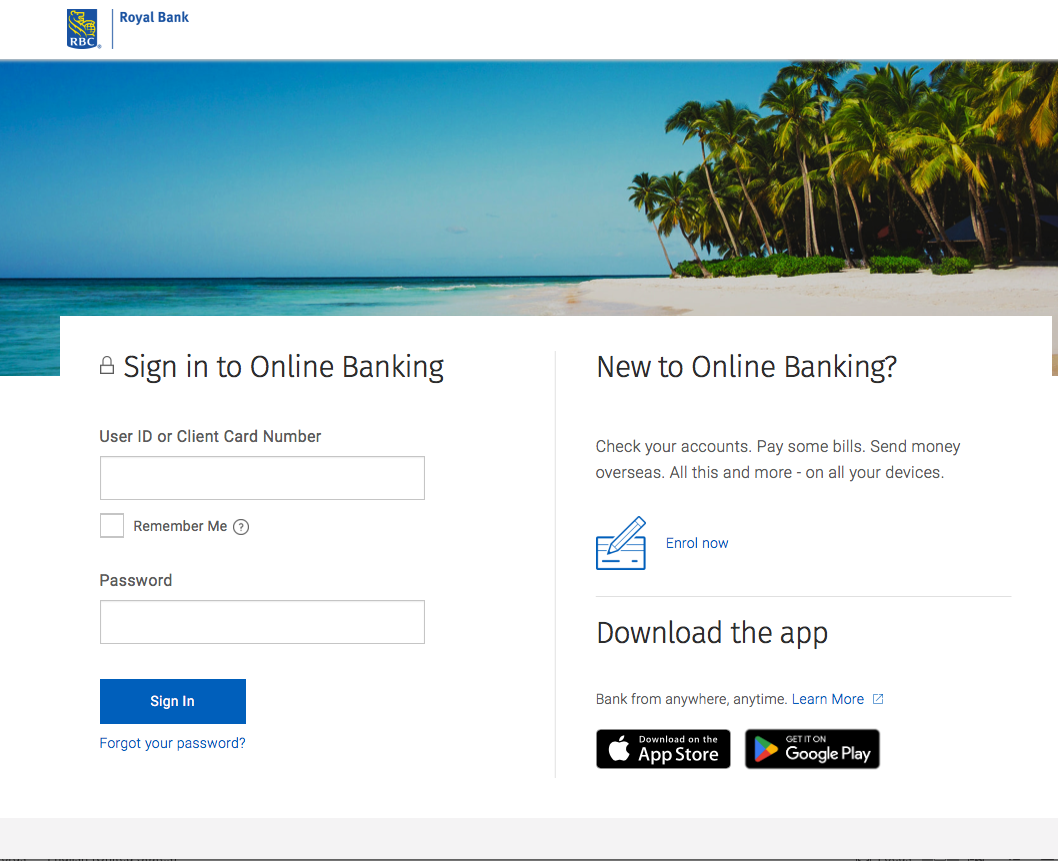

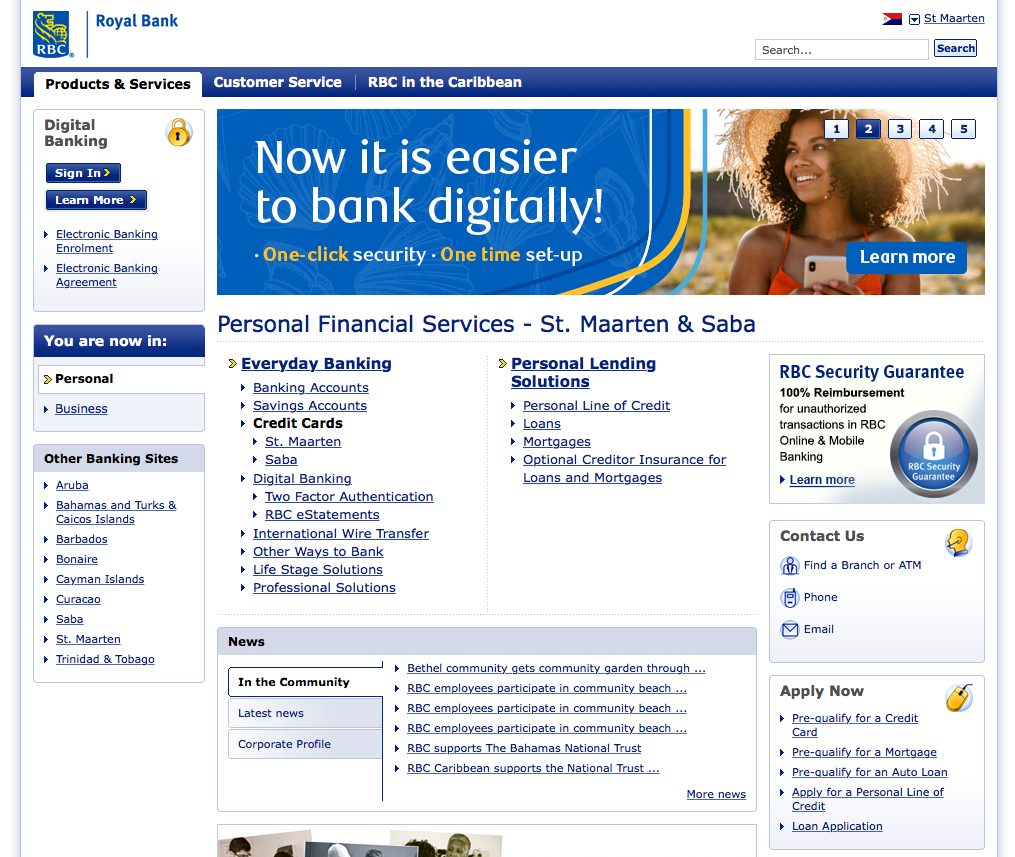

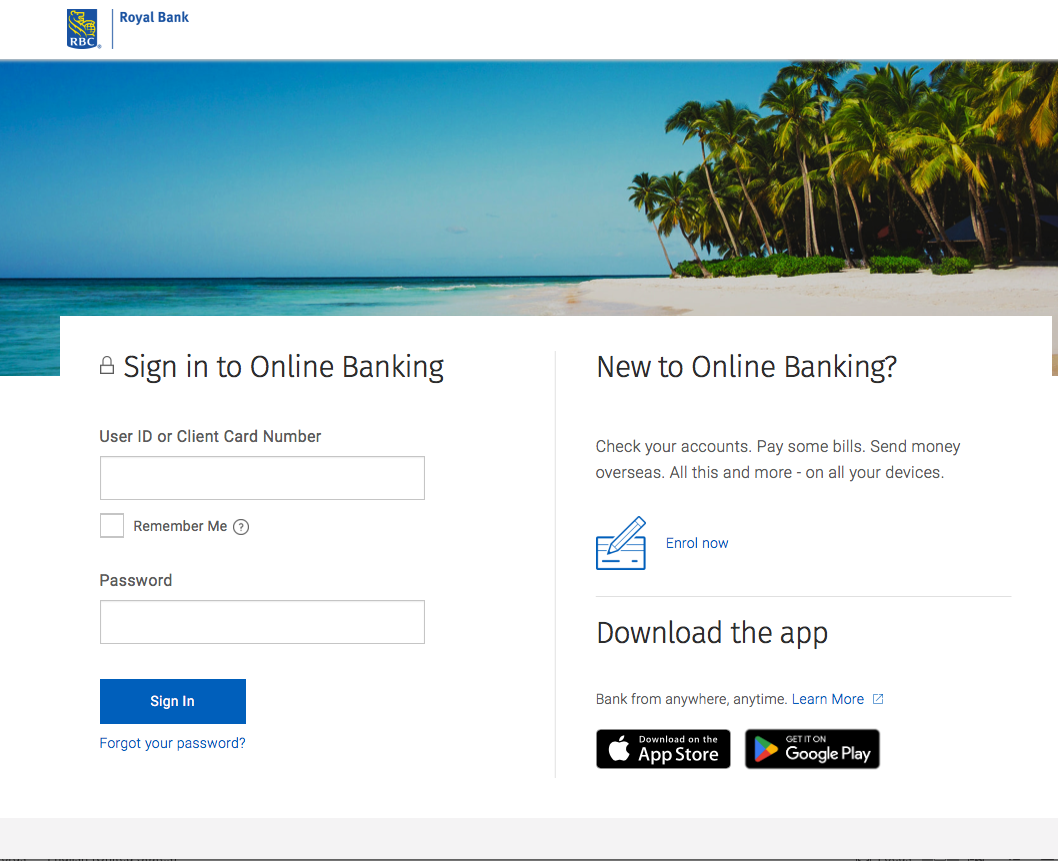

*** For those that want to see and get access to RBC Caribbean from the main RBC website, just go to the home page, and click on the link “about RBC” near the top center. Next click on “Caribbean” which will now show up right next to the left of “about RBC”. Now scroll down the page just a little and then on your right side you will be able to choose the location you want and then click the “GO” button. Now you will be able to see “Digital Banking” in the top left with a “Login” button. At this point you should be able to login and do your digital banking. Screen captures below.

RBC Subsidiaries

Description: RBC - home screen

Description: RBC - showing Caribbean link

Description: RBC - showing Caribbean landing page

Description: RBC - showing St Maarten landing page

Description: RBC - St Maarten Online Banking sigh-on page

Posted By: Carol_Hill

Re: Another ATM skimming incident - 08/14/2023 03:18 PM

OK, I have no idea how this post got to where it is and what is 'information' and what is 'misinformation'.

However, the original subject was about ATM skimming, so will end this one here.